Mainstream News On The GameStop Saga Has Gone Beyond "Fake News.” It's Straight Up Propaganda

If you’ve been following the WallStreetBets/GameStop saga, it’s revealed a number of things: the hypocrisy of the elites, how the elites are protected at the expense of the everyman, and the lies and propaganda of mainstream media.

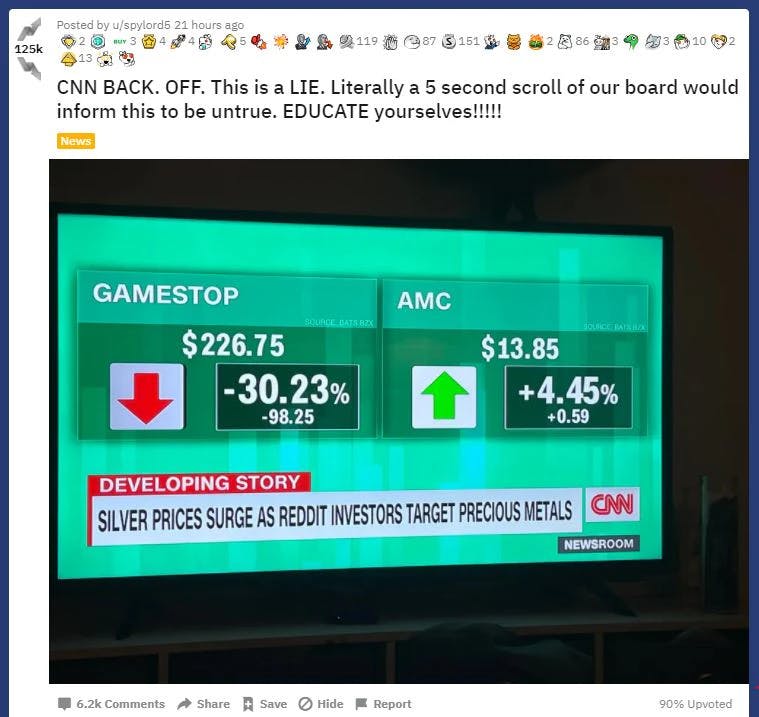

Recently, more articles from the mainstream media have come out, stating that Reddit was a driving force behind the surging price of silver. This was a blatant lie, and spending just a couple of seconds scrolling through r/WallStreetBets can prove it. This shows how the media has gone beyond spreading fake news — this is blatant propaganda in the interest of swaying the market in favor of hedge funds and the elites.

Some Financial Background

Let’s begin with defining some financial terms. A “short” in trading is an investment strategy, where the investor makes a profit if the value of a stock falls. Here’s what happens: a stock (a piece of a publicly-traded company) is borrowed from a broker and sold immediately at the current price. The seller (let’s call them John) then will wait for the price of the stock to fall so that the stock can be bought back, and returned to the broker, at a lower price. If the stock falls at a price lower than the one they sold at, this yields John a profit.

A “short” in trading is an investment strategy, where the investor makes a profit if the value of a stock falls.

To illustrate: John borrows a stock and sells it immediately for $20. John makes $20, but he still owes the broker a stock. Some days later, a news story reveals something terrible about the company whose stocks were sold, so the stocks go down to $2. John can buy the stock again, to give back to the broker, but he has made $18 in the process.

While this seems lucrative, this is no better than a casino game. There’s no guarantee that the price will go down (unless you have some buddies in news media who are in on the game and can spin a story to hurt the value of a stock…), so what happens if the price goes up?

John borrows a stock and sells it at $20. But instead of the price going down to $2, the price goes up to $30. John still owes the broker a stock and will need to spend an additional $10 to get it back. The price has no limit, keep in mind, so it’s possible for John to have an incredible loss with this. The higher the value of the stock goes, the more money John loses.

The GameStop Saga in a Nutshell

What even is the GameStop saga, and why should you care about it?

The GameStop saga has evolved such that it would be difficult to go into every single detail of the story. So we’ll cover the highlights and report on what this means to the ordinary person.

We can start with analyzing GameStop stock ($GME, in finance lingo). Basically, in February 2020, the value of the stock was $3.95. There were reasons for the stock to be valued pretty cheaply — the business had fallen behind compared to online competitors such as Steam (a platform to buy games online and interact with friends) and was reporting a mass-closing of stores. While this is bad news for someone who’s had $GME shares for some time, this is great news for short-sellers.

When a business performs badly, the news focuses on that. When the public’s perception is “this company is dying,” then shareholders (which includes ordinary people, for publicly-traded companies) will generally sell in a panic. A short-seller can then borrow-then-sell lots of shares. Then when the company keeps dying, they can buy the shares back for even cheaper and make a large profit.

However, instead of making a profit, in this case, the short-sellers found themselves owing a lot of money. The value of $GME began to increase around September 2020, not decrease. Around January 25, 2021, its value was at $76.79, and it nearly doubled to $147.98 the next day. The day after that, it was valued at $347.51.

The reason for that? It’s alleged that someone on r/WallStreetBets (a subreddit dedicated to playing the stock market like a casino) noticed that a hedge fund (basically an alternative investment fund that uses pooled resources) had a lot of short trades against GameStop. In simple terms, a hedge fund was betting on GameStop’s value dropping even lower. It’s unclear when exactly this began, but this user somehow convinced a large part of the subreddit to buy as much GameStop stock as possible, and this is what caused the massive surges in GameStop’s value.

The everyman beat the Wall Street elites at their own game.

A bunch of users on an internet forum was then able to sabotage this hedge fund, causing billions of dollars in losses for these short-sellers. The surging value forced the short-sellers to buy back the stock at massive losses, causing the value of the stock to go even higher. This scenario is what we’d call a “short-squeeze.” With these Reddit users holding on to their shares, there’s no relief in sight for these short-sellers. Even if these users don’t have this money in liquid form, many of them became millionaires overnight. The everyman beat the Wall Street elites at their own game, and this has unveiled new levels of hypocrisy among the mainstream media and the government.

Veils, Lifted

This whole situation has so many levels to it. We haven’t even mentioned the scandal involving the previously popular trading app, Robinhood, in which they allegedly sold users’ $GME shares without their consent. Additionally, we can see how many politicians, who claim to be on our side, truly are not. Some, like Alexandria Ocasio-Cortez, diverted attention to herself, instead of uniting with politicians across the aisle to address this larger issue.

Additionally, Elizabeth Warren defended the hedge funds:

This makes you wonder, how much do these politicians actually care about ordinary citizens? If Warren and Ocasio-Cortez actually cared, wouldn’t they highlight how this demonstrates the hypocrisy in the system? How are Americans given $600 for a forced-shutdown of everything over the course of a year, while hedge funds are bailed out in the billions? In terms of value produced, what do hedge funds do, compared to a hard-working business owner or employee?

It’s Beyond Fake News, It’s Propaganda

Recently, news began to circulate that silver was the new thing that redditors on r/WallStreetBets were buying up, and mainstream “comedians” called out the redditors behind the movement. Jimmy Kimmel called the redditors “Russian disruptors.” CNBC reported, “Silver jumps 8%, touches 8 year high as Reddit traders try their squeeze play with the metal.” CNN spread actual lies:

Source: Reddit

How do you know it’s a lie? Go to the subreddit. Not even a minute on the subreddit revealed users outraged at the spread of lies, telling each other to not buy silver, it’s a distraction to try to continue to bail out hedge funds and the elites who can’t stand having been beaten at their own game.

Closing Thoughts

You don’t need to be stock market-savvy to care about what’s going on around it. The entire saga has unveiled a lot about our politicians and mainstream media; they don’t care about you, they care about themselves, their alliances, and lining their own pockets. They blatantly lie and gaslight the public, whipping out the constant boogeyman, Russia, when they need the public to settle down and go back to being on their side. What we need to ask ourselves is, if they lied about this, what else have they been lying to us about?