Here’s What Happened With GameStop, Reddit, And Wall Street For People Who Aren’t Into Stocks

Let’s be honest. Deep down, we know how the influential people in positions of power don’t care one bit about us. But nothing screams “You are totally worthless to us!” more than what’s currently unfolding with the GameStop naked short selling saga.

I invest like a grandma. So when news broke that GameStop’s shares skyrocketed from $20 to over $400 in a few days, I (and the rest of America) took notice. It looks like some guys on a day trading Reddit group found out that a prominent hedge fund, Melvin Capital, was naked short selling GameStop’s shares. The Reddit day trading army retaliated by doing a short-squeeze on Melvin Capital’s bet. They succeeded, and made some money in return.

How Does the Stock Market Work?

Most of us who aren’t interested in the nuances of the stock market are understandably still confused at what’s occurring with the GameStop saga. I have a degree in economics, and it still took me years to properly comprehend the stock market and trading. But once you understand the basic fundamentals from a layman’s perspective, you’ll understand what’s going on.

Think of it like this. Pretend you’re the owner of GameStop. Your business is selling video games. In order to run your business, you have to raise money so you can pay for your business’s operations: rent, wages, insurance, inventory, etc. So you approach the public and ask “Hey, wanna help me run this business by giving me some money? I’ll share and give you part-ownership of the company.” The public’s money is “capital” and part-ownership are “shares.”

Trading: Long and Short

When you long a stock, you’re betting that the business will increase in value. Buy a share and hold onto it because you think it will go up. For example, if you think Tesla is going to be a great company for a long period of time, you’ll buy Tesla stocks now and hope that in 20 years when you retire, it will be worth 10 times what you paid for it today.

It’s kind of like buying a vintage Chanel purse. If you long the purse, you’d believe that the purse will rise in value in the future so you hold on to it. But if you believe that the vintage Chanel will lose its desirability over time, you’d short the purse.

When you short a company’s stock, you’re betting that the company will go down the drain.

When you short a company’s stock, you’re betting that the company will go down the drain. Borrow someone else’s share for the time being and sell it at a high price today with the hopes that the price goes down in the future. And in that future, that someone else will be stuck with a lower-priced stock which you can buy back cheaper to return it to them.

Let’s take the Chanel purse example again to illustrate shorting a stock: Borrow your friend’s vintage Chanel for a few years and sell it today at what you believe to be its highest price. The assumption is that the value will decrease so you can buy it back in the future for a cheaper price, and you’ll be able to return the purse you owed to your friend. This is an oversimplification, obviously, but it helps you understand the fundamentals of shorting a stock.

What’s Happening with GameStop’s Shares

In this case, Melvin Capital assumed that GameStop was going to go down the drain. So they borrowed a whole bunch of stocks from people who own GameStop shares, hoping that the shares will be worth less money in the future. Unfortunately for Melvin Capital, they took the wrong bet.

They got caught naked short selling GameStop by 140%.

Word got out that they were in a “naked short,” meaning that there are more stocks being traded than the total shares of the company itself. To put it simply, they borrowed too much. This is called naked short selling. They got caught naked short selling GameStop by 140% by the individual investors on the WallStreetBets subreddit who rallied their Reddit buddies to perform a short-squeeze on Melvin Capital.

Again, this explanation is an oversimplification of a complex trading strategy, but it will help you understand what’s happening.

Why Are People Celebrating?

Now to the interesting bit. If you’re like me, you probably didn’t partake in the mania. As previously mentioned, I invest like a grandma. Day trading is for people who enjoy the high stakes, high stress, but high reward trading strategy. I know that I personally can’t stomach the risk, effort, and stress that comes with day trading. On top of that, I’m aware of how the giant financial institutions can easily skew the market to give themselves a competitive advantage.

So when the WallStreetBets redditors decided to take on Melvin Capital, it was akin to a battle between David and Goliath. And David won. The individual investors, who were trading with money from their own brokerage accounts, managed to short squeeze Melvin Capital into taking on huge losses to the amount of $13 billion dollars.

But more importantly, many of these individual investors were trading with the intention of punishing the hedge funds for trying to “bully” GameStop into bankruptcy (a.k.a. Melvin Capital’s naked short selling). They view these hedge funds as “grifters” who would have gladly destroyed GameStop by over shorting the stock. And believe it or not, destroying GameStop’s business was probably the hedge fund grifters’ goal anyways.

The Kleptocratic Ruling Class Helping Out Their Kakistocrat Cronies

We need not shed a tear for their multi-billion dollar losses. Not only do these hedge funds enjoyed the benefit of fractional lending and artificially low interest rates, they’re also constantly getting bailed out by the American taxpayers whenever they mess up. This wholesale mooching on the American economy is made possible by the kleptocrats in the government who gets a cut of the action.

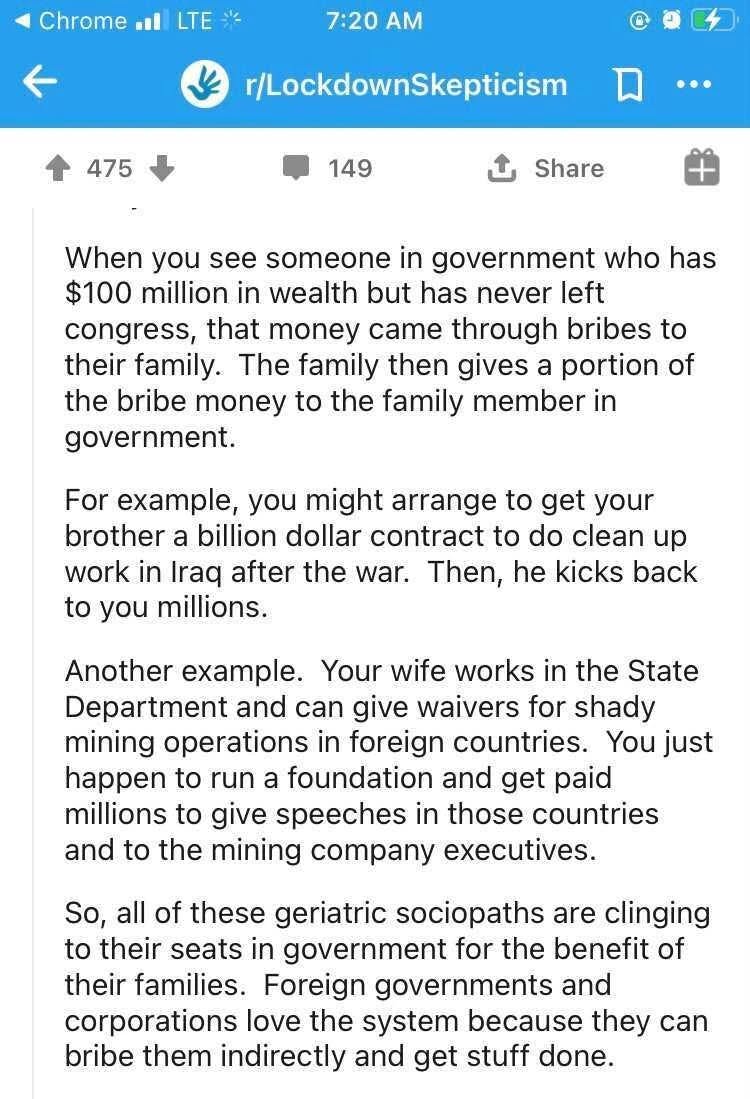

Screenshot from a Reddit discussion on one of my articles.

Imagine already having the odds stacked in their favor and they still manage to take a loss. Imagine calling yourself a hedge fund and not being adequately hedged against the risk. Imagine still losing a game that they’ve tried to rig in their favor. This level of ineptitude brings to mind what a kakistocracy looks like.

A kakistocracy is defined as “a society run by the worst, least qualified, and/or most unscrupulous citizens.” If you view the stock market as its own ecosystem, you’d realized that the ups and downs of the market are often led by the worst of its players. For example, my style of careful grandma investing strategy has negligible influence in the market. Prices are set primarily by huge and powerful institutional investors.

A kakistocracy is a society run by the worst, least qualified, and/or most unscrupulous citizens.

Now we’re witnessing how Melvin Capital (the hedge fund in question) was caught naked short selling and overexposed by a bunch of laymen of Reddit’s WallStreetBets. The redditors realized how dumb this move was and had a chance to do a short squeeze on Melvin’s GameStop’s position.

The Kleptocracy Strikes Back

Keep in mind, funds do short squeezes every day. But Lord forbid if the common man comes together and tries to get a part of the action. In order to choke off individual investors from further short-squeezing their GameStop’s position, we can see these hedge fund grifters running to their kleptocratic overlords in the government and the media to obstruct individual investors from continually buying GameStop’s shares.

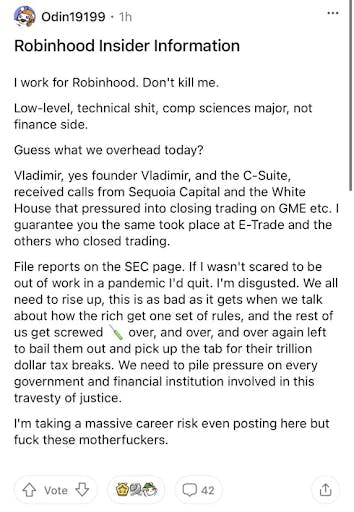

Screenshot shared on Twitter.

We saw RobinHood restrict trading on GameStop. We saw Discord temporarily ban the WallStreetBets Reddit group for “hate speech”. We saw Google deleting thousands of 1-star reviews for Robinhood after enraged users left scathing feedback on the app. CNBC, the leading financial news channel, went on the offense against the individual investors by bringing on talking-heads who warned the public against further inflating GameStop’s price.

They Don’t Care about You. They Never Did

Isn't it puzzling how almost none of these financial news networks even bothered to bring on the CEO of GameStop to talk about GameStop's business interest in the wake of this unprecedented move on Wall Street? A normal person would see this as a victory for a struggling company, as they’re given a second chance of survival by the general public who wants to keep them in business.

CNBC spread the narrative that private traders shouldn't flirt with the market because it's going to end badly.

But we know these financial and media establishments don't care about businesses. They never did. Instead, they’re more concerned with protecting the interests of the powerful hedge funds. CNBC would rather spread the narrative on how private traders shouldn't flirt with the market because it's "going to end badly for the public.” CNN’s Editor-at-Large, Chris Cillizza, likens this to “Trumpism”. The Guardian wrote a piece mocking the small-time traders as immature 4chan trolls. Bloomberg went so far as to call them “stock insurrectionists.”

Has it never once occurred to these kakistocrats that the American people had valid grievances with the corrupted establishment and this short-squeeze of the hedge fund is an ingenious form of a mass protest that doesn’t involve any violence?

Closing Thoughts

As I’ve mentioned previously, I invest like a grandma. It’s an investing style that works for me since I’m careful and conventional in my investing strategy. And if you’re like me, the revolt on Wall Street is a welcomed phenomenon because it opened my eyes and revealed just how corrupted some of these financial institutions, alongside their tech and media establishments, can be.

In a lot of ways, the individual traders who had the gall to take on a hedge fund did a favor for investors like me because they exposed what goes on behind the scenes in the market. I can’t speak for others, but I do take comfort in knowing that there are independent traders like the people on WallStreetBets who still keep a watch out against the kleptocrats who constantly destroy American businesses.