Curious About Crypto? Here Are 6 Things You Should Know Before You Make Your First Investment

What is crypto? How does it work? Should you put your entire life savings into crypto (spoiler alert, probably not). We’ll cover all this and more!

First thing’s first, I’m not a financial advisor, and nothing in this article should be treated like proper financial advice. For guidance on what specific money moves you should make, it’s best to consult a certified financial advisor who has a strong background in crypto.

That being said, the cryptocurrency (a.k.a. crypto) market is ever-evolving and ever-changing, so it’s worthwhile to know what crypto is, and the basics of how it works, especially considering the fact that some businesses, and even some nation’s economies, are now using it in the same way we use the U.S. dollar.

1. Crypto Is Not Just “Digital Money”

If this meme is you, worry not. We’ll get into a high-level overview of what crypto is, how it works, and how crypto transactions (specifically Bitcoin) are different from regular online transactions.

Even the traditional monetary system isn’t completely understood (or even remotely understood) by every single person. Why else would so many people believe that we should just print more money, or raise the minimum wage to $30/hour to provide a livable wage for people, or that universally forgiving all student loan debt is a good idea?

The term “digital money” is actually quite nondescript. You could be referring to digital U.S. dollars, like what people have in their bank accounts or what gets transferred during Venmo transactions. Or maybe digital euros, pounds, yen, pesos, or virtual currency in a video game. All cryptocurrency is “digital money,” but not all “digital money” is cryptocurrency.

It’s more accurate to think of cryptocurrency as a digital artifact, which can be transferred directly between two individuals, without any bank’s or the federal reserve’s involvement.

The transaction process for lots of prominent cryptos is secured using cryptography (the system of encrypting and decrypting information) and is written to something called the blockchain, which can be thought of as a massive ledger containing transaction information that is accessible to everyone who’s interested, not just a bank or government.

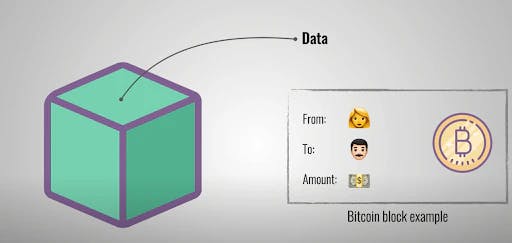

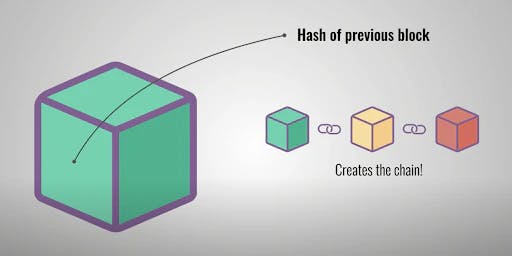

The blockchain can be thought of as a figurative chain of blocks that contain information. Each new block added to the chain will contain information about a transaction, and it’s very difficult to change an entry at a later time. Originally created in the 1990s, the blockchain was re-popularized in 2009 when it was adapted for Bitcoin (one kind of cryptocurrency) by Satoshi Nakamoto. Transactions on the Bitcoin blockchain work by writing information to a block, with a signature indicating that the transaction actually happened.

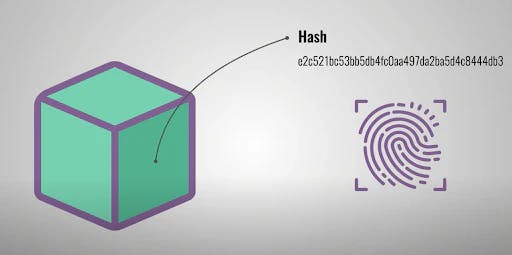

The Bitcoin blockchain writes data about who is sending the Bitcoins, to whom, and how much. Using that data, plus some private information about the sender, the blockchain receives enough information to generate a hash. Think of a hash like a fingerprint; it’s unique and identifies a transaction exactly. If the hash changes (from one long, elaborate string of characters to another), then anyone who is looking at the blockchain can tell that something about the transaction log was changed. Finally, a block will also contain information about the previous block’s information, to maintain the chain structure.

Image Credit: SimplyExplained

If this seems like a lot, it’s because it is. Cryptography is an entire science of its own, and you can delve into hours-long courses to learn more about it. This overview is relatively high-level, and just serves to demonstrate how cryptocurrencies like Bitcoin get transferred, and how it’s different from government-issued, also known as fiat, currency.

2. The Worth of a Crypto Token Isn’t Arbitrary

So we know that cryptocurrencies like Bitcoin aren’t handled by the government, and because of that, the process for Bitcoin transactions is quite different from traditional monetary transactions. How does the value of a cryptocurrency token get determined?

Like a lot of things – think traditional currency, gold and silver, stocks, and physical goods – the value of a crypto token gets determined by how much people are willing to pay for them, or the value people ascribe to them. Crypto, and especially Bitcoin, has the potential to be seen as really valuable.

Fiat currency is defined as a government-issued currency which isn’t backed by a physical commodity like gold or silver. Its worth is dependent on the worth or importance of the government that’s issuing it. Fiat currency, and other government-issued currencies for that matter, can be infinite, seeing how the U.S. federal government can just print money without regulation or limitations. If something is infinite, and there’s an insurmountable amount of it, it’s no longer valuable. How much would you be willing to pay someone for a bottle of water if you had no access to clean running water, and there was no indication when, if at all, that would change for you? Conversely, would you bother paying someone for that same bottle of water if there were a surplus of accessible, clean running water at your disposal?

This concept applies to Bitcoin and other cryptos. If the government prints money willy-nilly without any regard for how that will affect the middle and working classes, the value of the dollar goes down. What previously cost $5 will cost $10 because the dollar is worth less than before (i.e. inflation).

Enter Bitcoin. It’s a finite resource. There are just under 20 million bitcoins in existence, so at some point in the future, no one will be able to buy new tokens, they’ll only be able to be exchanged between individuals. If a government devalues its own currency, then the people have the power to make use of a different currency that is finite. So people may be willing to value Bitcoin very highly. At one point, it was worth about $60,000 USD, although its value has shifted dramatically in the past. It’s currently (at this exact time of writing) worth just above $29,000 USD.

3. There Are Thousands of Cryptos Out There

At this exact moment of writing, there are just under 20,000 cryptocurrencies listed on CoinMarketCap. Some of the more prominent ones you may have heard of (either in online discourse or on the news) are:

Bitcoin (BTC)

Terra (LUNA)

Dogecoin (DOGE)

What’s the difference between each one? Is one better than another? Why the heck are there so many coins?

Crypto is a relatively new thing, so coins may be created by people trying to one-up Bitcoin (which is regarded by many as the “first in, best dressed” crypto). Other people want to join in on a meme, as we saw with the boom in Dogecoin popularity in 2021. And others still may be creating a coin and promoting it for the purposes of scamming people (more on that further down the list).

Before buying any cryptos, do your research and consult a financial advisor for concrete advice on what you should or shouldn’t do. CoinMarketCap is a very good resource for getting an overview in how a coin operates, if it uses the traditional blockchain or a blockchain with modifications, and how many coins are in existence (for instance, we discussed Bitcoin has just under 20 million, but Dogecoin has about 132 billion). You can also find resources online that outline the differences between cryptos, so you can compare for yourself and know what questions to ask, and what you want to know more about.

A good rule of thumb, if you insist on venturing into your crypto investment journey on your own, is never spend an amount of money that you’re not okay with losing, should the investment go sour.

4. You Can Buy Cryptos from Your Phone

Despite the elaborate process of crypto transactions, you can buy cryptos straight from your phone! If you have purchased stocks through Robinhood, you can purchase crypto through the app as well, although at the time of writing, you can’t send cryptos to other people like you can using other exchange apps like Coinbase. Robinhood may not be the app for you in case you want to be able to send crypto.

An exchange I personally use is Coinbase, which serves as an exchange and digital wallet. It’s easy to sign up and the interface for sending or receiving crypto is reminiscent of Venmo. There are plenty of exchanges out there; you can see which ones people are using here.

5. A Primer on Pump-and-Dump Schemes

Whenever there’s a new avenue for investment and potential money-making, there’s always a string of people willing to try to exploit you for their own gain.

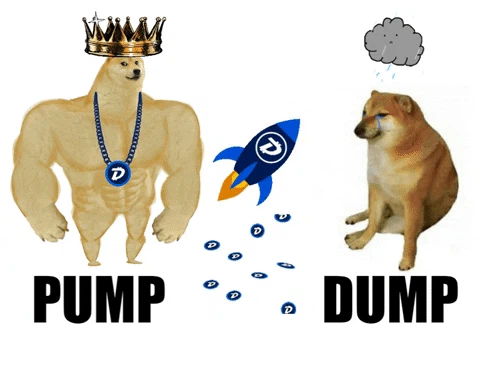

A pump-and-dump scheme is pretty much as the name implies: someone convinces a large number of people to buy a particular crypto, which pumps up the value because all of a sudden many people are trying to buy it, which drives up scarcity and value. Then, when the crypto is worth a lot of money, the schemers sell all their tokens. It’s usually for a lot of money, since they were the ones convincing others to drive up the value of their token. If, all of a sudden, a lot of those tokens are being sold, the value goes down, leaving the “investors” holding the bag.

How do you avoid becoming a victim of these schemes? For starters, you should be wary if a coin gains massive popularity all of a sudden and becomes worth a substantial amount of money when literally in the days prior it was worth nothing. Secondly, look into the coin as much as possible, and ask yourself “Is there anything about this that’s truly revolutionary and worth an investment?” Thirdly, and I cannot stress this enough, never invest any amount of money that you aren’t willing to lose!

6. Crypto Is Not a Reliable Means To Get Rich Quick

As cool as crypto is, and as lucrative an investment as they can appear to be, it’s not a means to get rich quick, or at least, you shouldn’t look at it that way. Seeing as it’s still quite novel, we’ve yet to see if crypto will one day replace the U.S. dollar, or all other currencies, or if it’ll effectively be treated the same way that stocks are treated. Or maybe in the end, some natural phenomena happens that kills all technology and crypto losses will be the least of our worries.

Mostly kidding. But the point still stands. If you look to new tech as a means to get rich quick, it’ll more than likely backfire on you. Be wise with your money, and do your homework before plunging into an investment!

We want to know what you think about Evie! Take the official Evie reader survey.