The Man Who Predicted The 2008 Crash Says We Need To Open Up The Economy Immediately

Everyone right now, including President Trump, is determined to follow the medical advice of “experts” like Dr. Fauci. But as they’re so focused on every minute change in the medical community's opinion, they are missing a whole other group of experts, who are just as essential: economic experts.

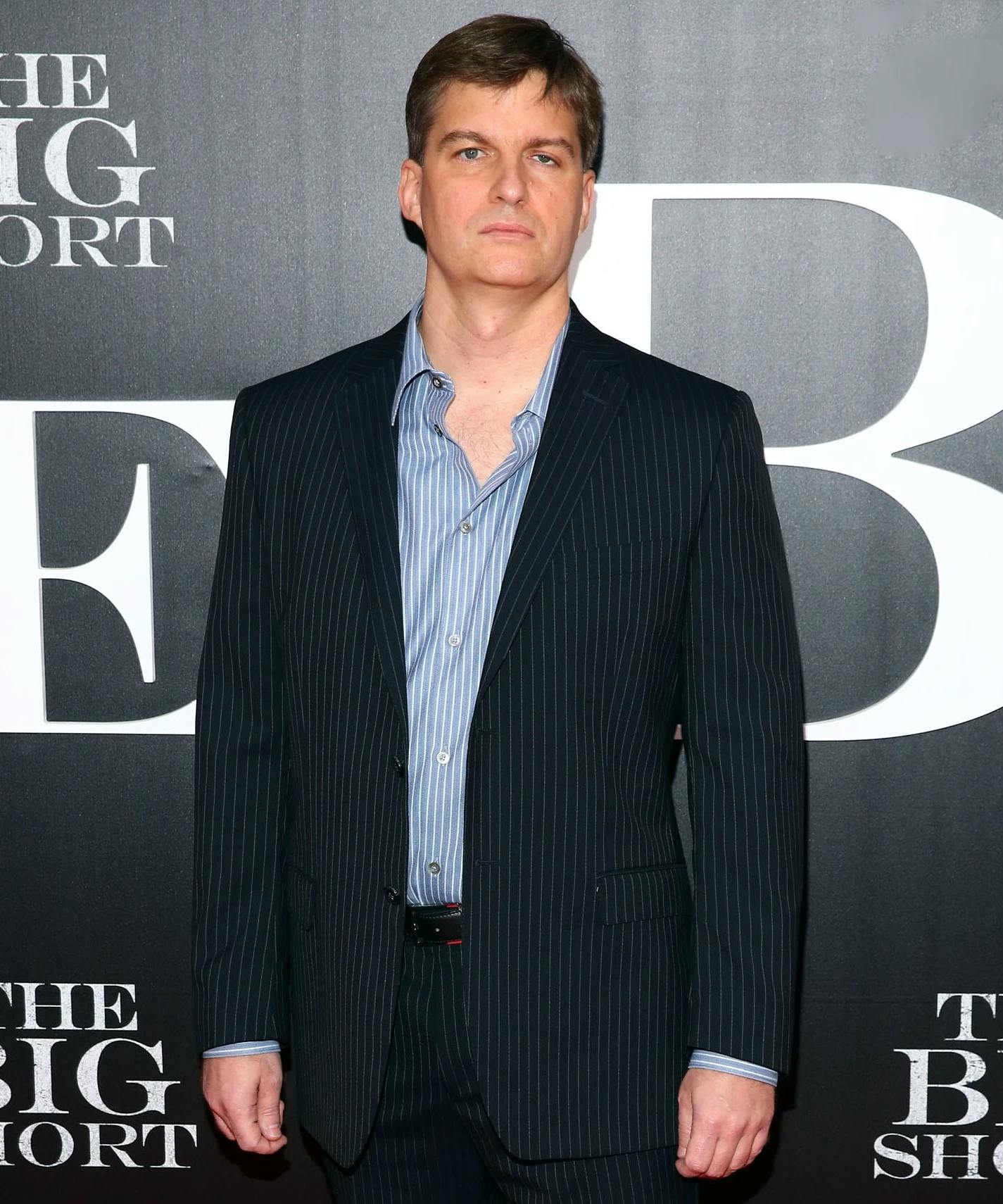

By now, everyone knows who Dr. Fauci is. Hence, the “safer at home initiatives.” Bet you’ve probably never heard of Michael Burry — but in the field of economics, he’s arguably the leading expert. He might not be a household name, but you’ve probably seen him portrayed by Christian Bale in The Big Short.

Michael Burry and The Big Short

As early as 2003-2004, Michael Burry suspected that sub-prime loans were a ticking time bomb. Flexible rate mortgages had been touted by experts, including Federal Reserve Chairman Alan Greenspan, as a miracle solution to low-income people who wanted to buy a home. Burry knew that the interest on these loans was only held flat for two years, after which it would skyrocket, leaving most borrowers unable to repay their loans. The defaulting on thousands of loans would cause massive ripple effects in the economy — which culminated in the 2008 crash.

Burry used the money from his hedge fund, Scion Capital, to buy credit default swaps against the sub-prime loans. The strategy is too convoluted to describe here, so I would just recommend reading The Big Short. But suffice it to say that his bet paid off, and he made $100 million while the rest of the economy crashed and burned.

The federal government and banks have no interest in learning from their mistakes to prevent a future crisis.

In an op-ed in The New York Times in 2010, Burry refuted Alan Greenspan’s claim that no one could have predicted the housing bubble. Burry says no one in the federal government or any bank has ever asked him how he was mysteriously able to predict the biggest economic crash in a hundred years. Instead, Greenspan claimed Burry’s prediction was nothing more than a “statistical illusion.” Clearly, the federal government and the banks have no interest in learning from their mistakes to prevent a future crisis. In fact, the response now has been eerily similar to the failed response over a decade ago: government bailouts that will only delay but not prevent a catastrophic economic failure.

Now, Burry is warning that as devastating as the 2008 crash was, the economic consequences of this coronavirus shutdown will be worse — much worse. On March 23, he created a Twitter account to start spreading the word: we need to reopen the economy immediately or we may never recover.

Listen to the Experts

The incredibly stringent lockdown measures that began in the U.S. at the end of March were mostly in response to a study published a few weeks earlier by the Imperial College of London. Researchers estimated 2.2 million deaths in the U.S. if no preventative measures were taken. Panic spread through the nation, and governors and mayors, desperate to take action, began shutting down their cities and states. But less than two weeks later, the author of the study retracted the high estimates and instead began referencing numbers that were less than 1/10th the original estimate.

So which is it? An incredibly deadly disease that will wipe out 1-2% of the population, or is it just a really bad flu?

On Thursday, Dr. Fauci put the estimate even lower: 60,000. While the number sounds horrific, it’s about within the range of a bad flu year. So which is it? An incredibly deadly disease that will wipe out 1-2% of the population, or is it just a really bad flu? Clearly, even the so-called experts are flying blind here. Yet we are supposed to trust and follow everything they say. Even the CDC, who first said that masks would not prevent the virus, is now calling for all Americans to wear them.

I’m not proposing that we ignore the advice of medical experts, but clearly there is a lot of misinformation and confusion at play. Numbers and estimates change by the week. Governors and mayors jumped at the chance to institute massive lockdowns at the advice of medical experts, but they forgot to consult another group of experts first: economic ones.

Since the beginning of the crisis, politicians and medical experts alike have shown a shocking disregard for the economic consequences of these mandatory shutdowns. Over the last three weeks, 17 million Americans have filed for unemployment. It’s a staggering number that dwarfs previous records from the Great Recession. Economists at Pacific Investment Management Co. (PIMCO), one of the world’s largest investment firms, estimates that the U.S. economy will shrink by 30% in the second quarter of the year, and up to 20% of Americans may find themselves unemployed. Small businesses around the country are already starting to close, and how many more will perish during another month of shutdown efforts?

But, you will say, isn’t all of this worth it to save the lives of the people who could die from the virus? To save a life at any cost? Perhaps, but economic choices have consequences too.

The Economic Consequences Might Be More Than We Can Bear

“Universal stay-at-home is the most devastating economic force in modern history,” Burry wrote in an email to Bloomberg News. “And it is man-made. It very suddenly reverses the gains of underprivileged groups, kills and creates drug addicts, beats and terrorizes women and children in violent now-jobless households, and more. It bleeds deep anguish and suicide.”

Burry’s warnings ring true. Calls to the U.S. National Suicide Helpline have jumped 891% since the crisis began. The New York Times is reporting that instances of domestic violence are up worldwide. Job losses hit minorities the hardest: about half of Hispanics report that someone in their household has lost a job or has seen reduced hours, compared to only 33% of all U.S. adults. Bloomberg expects we are about to see the biggest number of defaults on mortgages in history. If a mortgage crisis is what caused our last recession, it’s dangerously naive to waive this off as a passing issue.

The nation has spent so much time responding to the overblown predictions of medical experts that they’ve forgotten that an economic crisis can be just as or more devastating than a medical one. It seems like the man responsible for predicting the last big economic collapse might be worth listening to this time around.

A Path to Opening the Economy

So far, we have heard a disturbing lack of conversation from the president and state governors about their plan for re-opening the economy. As of today, the only governor who has even announced such a plan is Governor Abbott of Texas. Michael Burry has proposed a three-pronged approach to allow at least some people back to work as soon as possible:

1. Identify life-saving drugs and make them readily available. Hydroxychloroquine has been approved for emergency use by the FDA, and it’s known to be a safe drug for its main use, treating malaria. The FDA has also drastically relaxed their standard testing procedures for new treatments, so doctors have the ability to test experimental treatments quickly.

2. The elderly and immuno-compromised continue to shelter in place. One thing we do know about the virus is that certain groups are at a much higher risk than others. We should protect the vulnerable by limiting our contact with at-risk groups and allow them to shelter in place until a known treatment or vaccine is developed.

3. We return to work with new safety practices in mind. Companies should create plans for allowing employees back to work, keeping safety in mind. Washing hands, wearing masks and gloves, and reducing in-person contact will all reduce infections. It would be easy to implement short-term measures that will allow people back to work, without increasing their risk of infection.

Governors should also not assume that all states will have the same experience. There is no reason to think that South Dakota, with a very small and dispersed population, will have anywhere near the experience we have seen in New York. In fact, no place else in the nation has seen numbers akin to New York. To treat every state with the same stringent measures is dangerous and misled. Texas is different than New York, and its governor is responding accordingly. The more of the country we can re-open, the more quickly economic activity can resume.

Even within their states, not all towns are created the same. The San Francisco/Bay Area has seen the highest number of infections in California, but it also has the highest population density in the state. Small towns in the Central Valley, where many agricultural workers are still going to work, do not need to follow the same measures.

Closing Thoughts

The issue of shutting down an entire country is more complicated than it’s being given credit for. We’re so focused on taking doctors’ medical advice about the disease that we’re ignoring economic experts’ warnings about the economy. The solution to this virus isn’t as simple as “stop the world.” Politicians and leaders have been quick to jump to action on over-inflated numbers and fear-mongering facts touted by medical “experts.” But they’re ignoring the dire, and more realistic, warnings of economic experts. Politicians are underestimating or ignoring the economic consequences of their rash decisions. If Americans want to preserve their way of life, we need to stand up to protect the businesses and livelihoods we have worked so long to build.