Home Ownership Is Possible. Here’s How To Achieve It

The stereotypical American Dream typically included a spouse, 2.5 children, and a picturesque home in the suburbs with a white picket fence. In recent years, the home ownership part of that dream has been deemed impossible to achieve, and replaced with dreams of having a small, trendy apartment in the big city.

If you’re like me and many other 20-somethings, you may find it fun to watch videos of apartment tours in big cities around the world, home improvement and DIY, and home/apartment makeovers. Apartment tours especially portray an image of an idyllic yet busy life, and for quite a while I wanted that for myself.

However, a part of why that’s pushed as desirable, or the default housing situation for 20-somethings, is largely because of a lack of understanding and education about home ownership provided to teens and young adults. It’s not impossible to own a home, especially in an age where you can monetize everything, but it does take quite a bit of hard work and discipline. Being a homeowner is more attainable than you may believe, and for some people, it makes a lot more sense to do so for their long-term financial health.

A Breakdown of Renting vs Home Ownership

Let’s take a look at apartments in Austin, Texas, and mortgages in Texas with a focus on the areas surrounding Austin. Here’s a breakdown for renting an apartment smaller than 900 square feet:

Average monthly rent = $1,398

Utilities (low end estimate) = $265

Total monthly expense = at least $1,663

While home prices are on an upward spike (thanks to many relocating due to COVID and to civil unrest in the past year, or the liberty brought about from the flexibility of working from home), it’s still possible to find homes in the Austin area for under $300,000, which in some cases can result in a mortgage payment of just a couple hundred dollars more (or even less!) than the base price of an apartment.

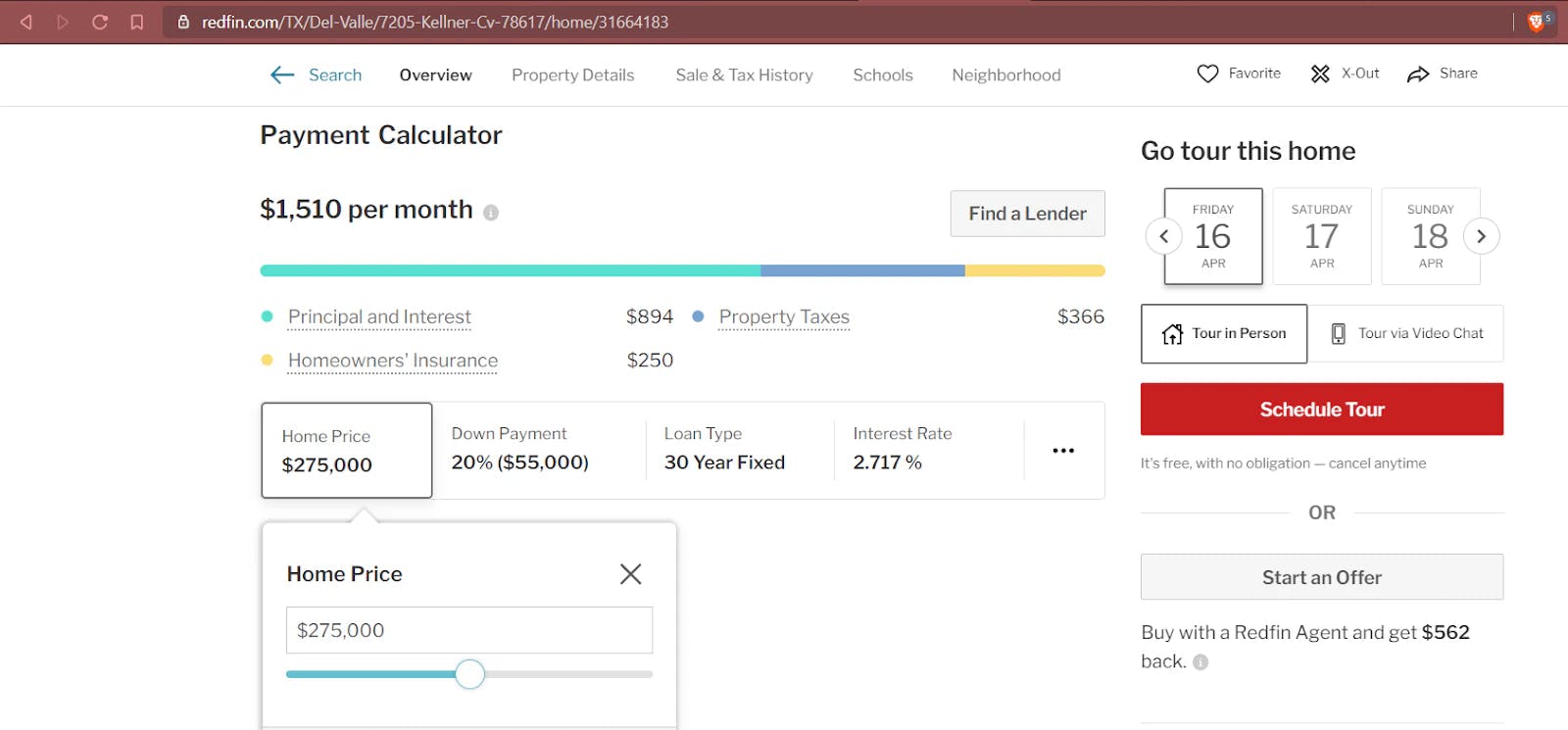

Just take a look at a cost estimation from Redfin, on a home that’s $275,000. We’ll go more into the amount breakdowns later:

In the short term, the increase of a few hundred dollars may seem less than appealing, especially when down payments are something to consider. Not everyone has $55,000 for a 20% down payment laying around. However, owning a home comes with a slightly different breakdown than renting if you start to think long-term.

30 Years of Rent vs a 30 Year Mortgage

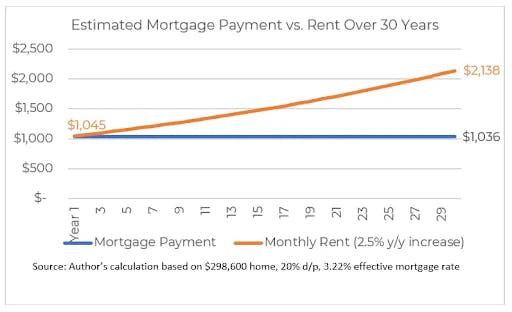

There’s variation depending on which region of the country you’re in. In certain counties and cities, growth is through the roof, which translates to increases in rent and a shortage of apartment vacancies, which makes home ownership a better option.

Over the course of 30 years (the traditional length of a mortgage), let’s say the apartment rent we mentioned above magically stays the same (though it won’t) — you’d end up paying $503,280. In part because of the current interest rate at the time of writing (just below 3%, so still very good), you wouldn’t be paying that amount on a sub-$300,000 house over that same time period.

Renting long-term could end up costing more than paying off a mortgage.

Additionally, certain kinds of loans keep that interest rate fixed, meaning that no matter how much the market changes, your monthly mortgage amount will remain the same month after month. If we make our comparison more accurate, monthly rents tend to change vastly over the course of that many years, seeing as how the median rent in the United States in 1960 was just under $600. Since then, it’s more than doubled, if we compare it to the rent in Austin!

Here’s something to further illustrate the costs over time:

Image Credit: Nar.Realtor

Considerations of a Renter vs a Homeowner

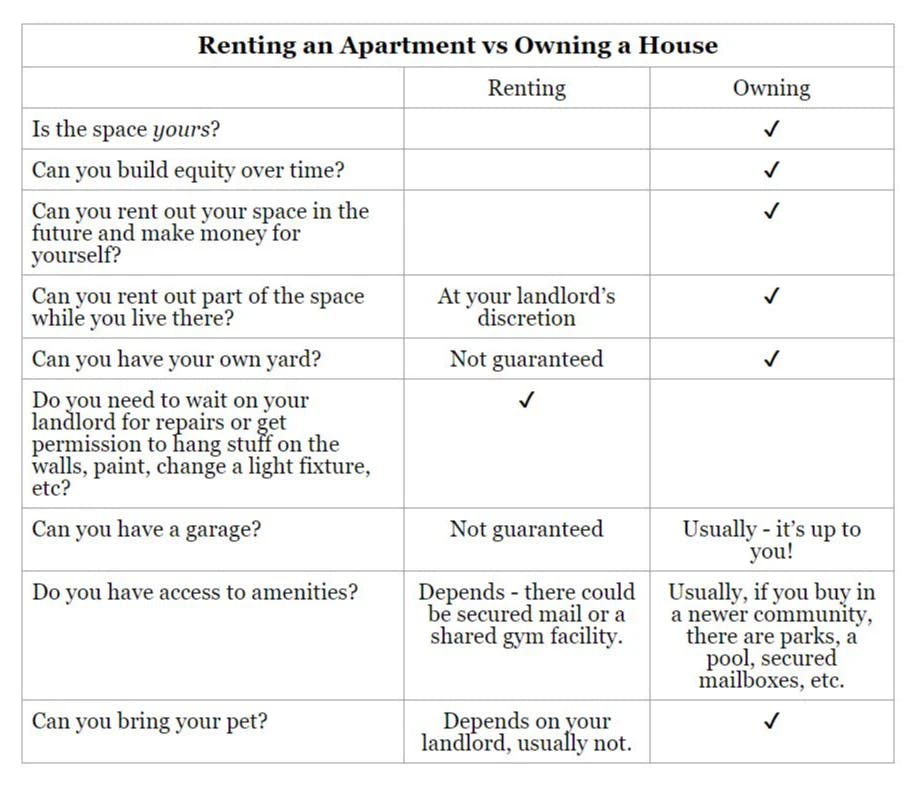

For a lot of people, renting makes sense, especially when you just need a place to live. The costs of renting are often less than, or comparable to, the costs of owning your own place. And the convenience of outsourcing maintenance and repairs to the landlord might outweigh the impermanence of renting. Other people want the long-term financial benefits, stability, and empowerment that come with home ownership.

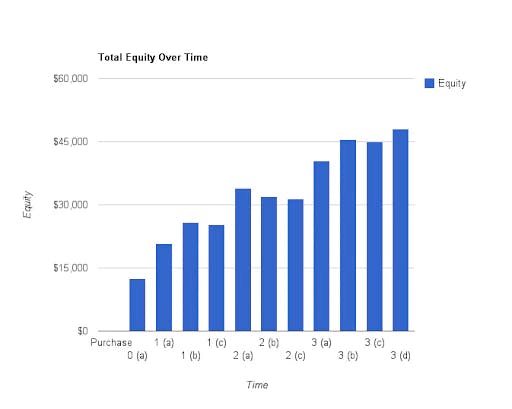

Let’s look at some of the long-term financial benefits of owning your own home, To start, let’s define “equity” (no, not in the social justice context). Put simply, it’s the current market value of your home, and depending on where you live, it’s possible to make a lot of money from your home equity.

Your home equity could increase over time, which increases your net worth.

Let’s say that you buy a house worth $100K. If you put down $20,000 initially, you’d have $20,000 in equity already. If your home never increases in value, your equity increases with the monthly payments that you make (the part that doesn’t go towards the loan interest). When you’ve paid $5,000 towards the mortgage principal, your equity would be $25,000. With the current trends, it seems many homes are increasing in value just from the demand for housing. Using Austin again as an example, the median home price 5 years ago was $351,500, while today it’s $532,950. If you bought a house there just five years ago, your equity would contribute to your net worth immensely.

The graphic below is from the early 2010s, but it illustrates equity growth over 3 years. Given the demand for housing these days, the growth is likely higher over shorter periods of time.

Image Credit: Gimme-Shelter

Aside from the boost in your net worth, there’s more creativity and autonomy allowed in being a homeowner. You can paint your walls black or whatever color you want, rip up the carpet, put up a wall, tear down a wall, change a light fixture. You don’t have to wait on an apartment complex maintenance employee to repair anything, you can do it yourself or hire someone to do it — and there’s something empowering about that. Everything you do is for you; it’s not for someone else or for the benefit of someone else.

A homeowner doesn’t need permission to make alterations or wait on someone else’s timeline.

There are also a lot of bonuses that come with living in a house that you just can’t get in a city apartment, like a garage for storage and car protection, a yard, and a front door at ground level. Overall, there are different lifestyles that come with living in an apartment in the city, versus a home that’s near it.

So How Do I Attain Home Ownership?

It’s one thing to sing the praises of home ownership, but when prices are going up, it may seem especially unattainable. But again, it’s not impossible.

The short answer to “how do I attain home ownership” is to save, analyze your spending habits, and set a target.

Save Money

What’s the best way to save money? Spend as little as possible and save. Seriously, even if it means skipping out on treats a lot and being disciplined with yourself. Consider living with roommates to split the high cost of living in an apartment.

Get roommates or rent a small space short-term.

Analyze Your Spending Habits

The best way to figure out your spending habits is to budget, and this helps with saving too. For a whole month, record in a ledger what money you’re spending and when you spend it. I recommend you do this manually, without an app, so you’re more conscious of where your money is going. In your ledger, record what category the spending falls under. For instance, “necessities” would constitute groceries, rent, utilities — whatever you can’t do without. “Fun” could make up shopping for clothes or home goods, trips to the salon, buying games or books, etc. — things that you can hold off on or find a cheaper alternative for. (If you want to work from a a budget template, check out this one.)

After a whole month, and especially after a few months, you can see where your money is going, where you spend the most, and when you’re spending it. From there, make adjustments to minimize your spending, and save everything you have left.

Set a Target

When you know where your money is going, and you’ve gotten into the habit of saving, you can set a target for yourself. Start looking for homes in the price range you’d like to aim for. Ideally, no more than 30% of your monthly earnings will go towards your monthly payment, with everything else being divided up between necessities, savings, and fun stuff (also ideally in that order). Remember, there’s such a thing as a “starter house” — it’s one you can live in and build equity with, but it’s not necessarily your forever home if you want a large family or if you’re unsure about living in your current area for a long time.

No more than 30% of your monthly earnings should go towards your monthly payment.

Contrary to popular belief, you don’t have to put 20% down on a home, doing that just allows you to avoid paying private mortgage insurance (PMI). You can put as little as 3.5% down (on a $400,000 house, that’d only be $12,000). Do keep in mind PMI can add up. Many apps like Zillow and Redfin have a monthly payment calculator, so you can get a rough estimate of what your monthly payments would look like.

Finally, keep in mind that there are other costs associated with buying a home: moving costs, which can run very expensive if you have a lot of stuff to move; closing costs, which are those associated with buying the house itself (you can get an estimation with online calculators); inspection and repair costs, if there are repairs that you’re opting to pay for yourself; and a safety net, just in case pigs start flying or something. Having money set aside, not just for your down payment but for other things as well, is very important!

Closing Thoughts

While owning a home can be more expensive at first glance than renting, there’s potential to put yourself in a much better financial position than before. You can make your house your own without asking anyone’s permission, and you can call it your own. Even if you’re planning to get married, I recommend you buy a home of your own. If nothing else, you can sell when you do get married and use the money to buy another house for you and your spouse, or you can rent your home out and have a supplemental source of income.

While renting an apartment is the trendy thing to do, there’s more empowerment in owning a home. It’s truly your own portion of the world.

Love Evie? Let us know what you love and what else you want to see from us in the official Evie reader survey.